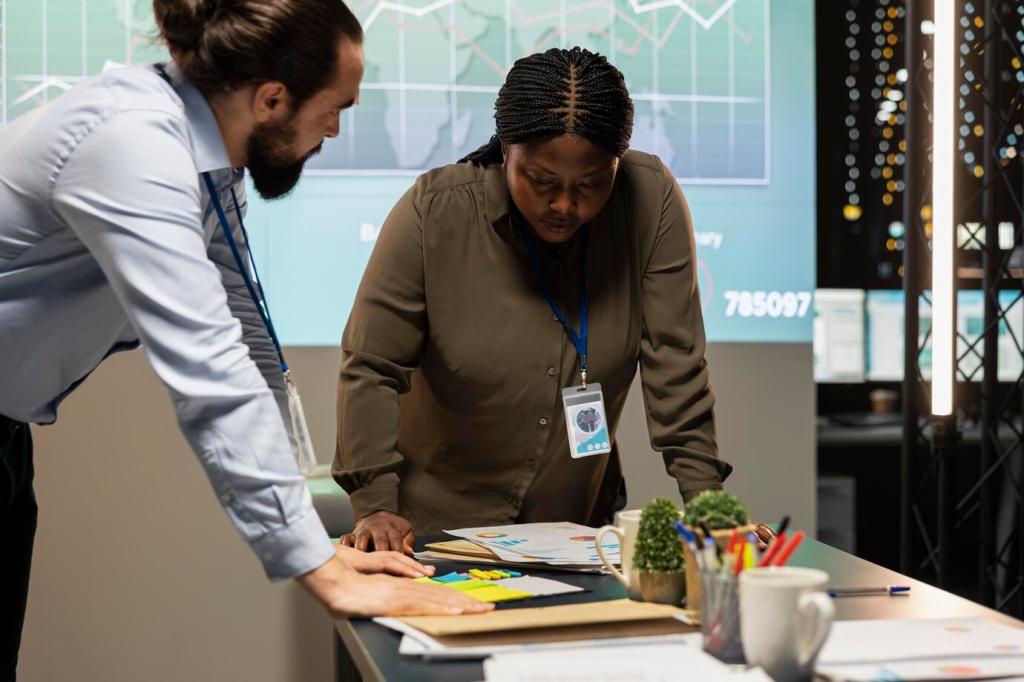

Support from Employers and Industries

Frame your request around measurable gains: reduced backlog, new certifications, or expanded client capacity. Offer a learning plan, propose timelines, and explain how coverage reduces turnover. Ask about service commitments, grade requirements, and eligible institutions before enrolling.

Support from Employers and Industries

Many unions, guilds, and associations fund members seeking credentials or continuing education units. Check your membership portal and newsletters for application windows, eligibility, and award history. Share in the comments if your organization offers hidden gems others should know.